The significant house price growth seen during the pandemic was followed by a dip last year, mainly thanks to inflation having hit double digits and the base rate reaching a 15-year high of 5.2%.

However, looking at data for the last few months, it’s clear that prices across most of the UK are starting to pick up again.

So, the headline news as we head towards the end of the summer is that the market is pretty stable and things are looking positive for the rest of the year.

What were the forecasters predicting for 2024?

In 2023, although average house prices fell by between 5% and 10%, that wasn’t anywhere near as bad as some experts were forecasting.

This year, the expectation was that we would see prices drop further, by a few percent. But the market has turned around much quicker than predicted and it was obvious even at the start of 2024 that people were actually keen to get moving again.

And this consumer confidence was boosted by lenders beginning to bring down mortgage interest rates, in anticipation of the Bank of England reducing the base rate in the summer.

So, by May, the majority of forecasters had begun to predict modest rises of 2-4% for most regions.

What are the latest figures?

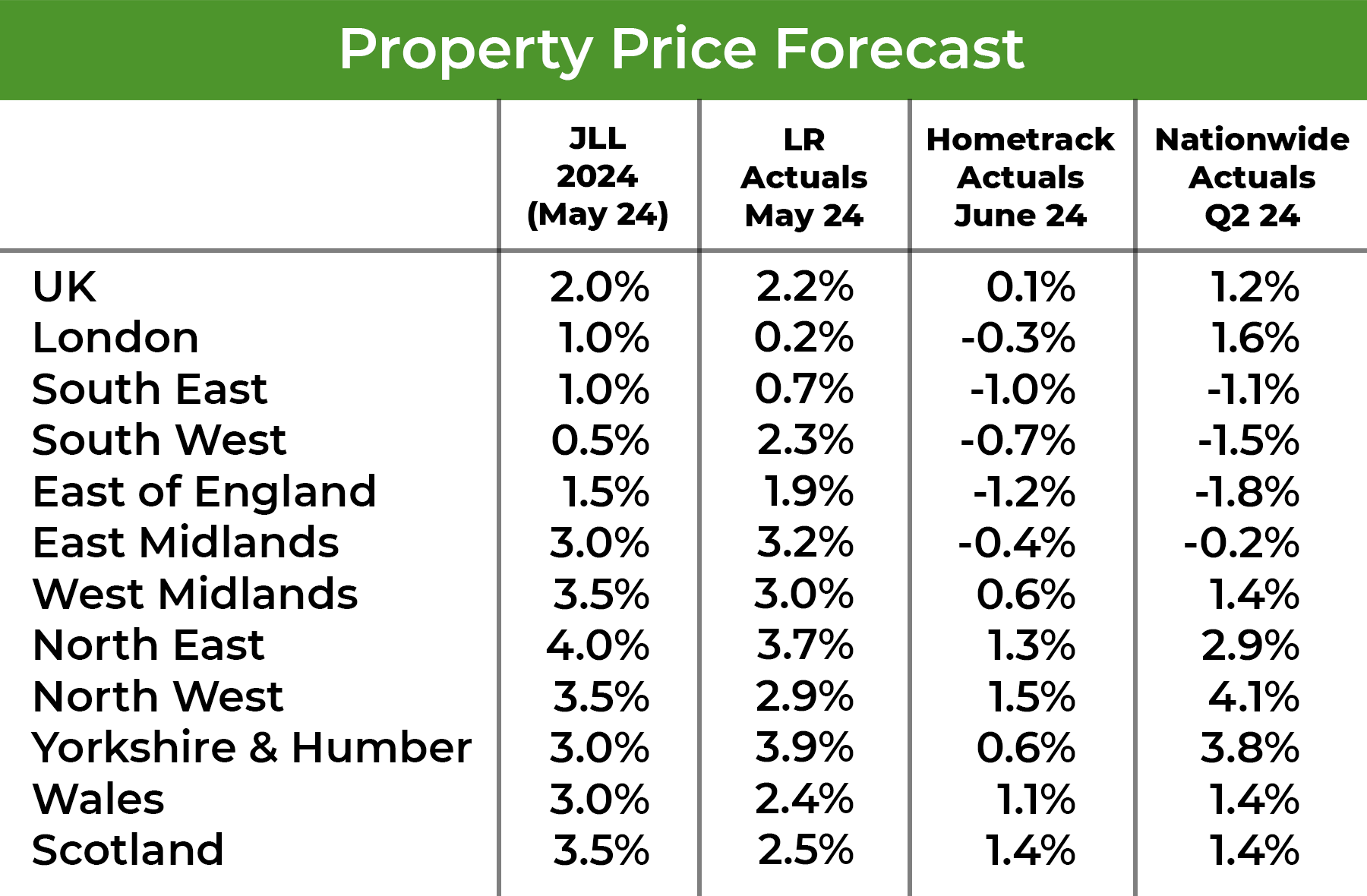

The above table shows a summary of JLL’s forecasts for 2024 and the actual figures reported by the Land Registry, Hometrack and Nationwide as at May/June.

Note that Land Registry data tends to lag the other indices as it tracks sold prices at the point of registry. That means it can be 3-6 months out of date, depending on how long the transactions took to complete. The most up-to-date pictures of price performance come from Hometrack, which takes account of both mortgaged and cash sales, and Nationwide, which tracks purchases with a mortgage.

Although most of the forecasts for 2024 are currently looking a bit stronger than the actual figures to date, we expect the market to catch up. We’ve only just had the first base rate reduction in 12 months, and it’s forecast to come down further by the end of the year, so we anticipate the predictions for the year as a whole to be more-or-less correct.

Transaction levels

Even though the media tends to lead with reports on house prices, transactions – that’s the number of individual properties sold - are often a more useful measure of how well the housing market is performing.

Every year, on average, we sell around 1.2 million homes, although this can vary quite dramatically, depending on what’s happening in the UK economy or the rest of the world. For instance:

- In the first year of the COVID-19 pandemic, transactions fell to around 1m

- In the second year, they rose to 1.5m, which caused huge amounts of stress and strain on home moving services

- In 2023, with high inflation and big mortgage rate rises, they fell back to around 1m

This year, the expectation was that we’d see about a million transactions again but we seem to be on track for around 1.1m – good news for buyers, sellers and the industry as a whole.

A busier market means it might be more difficult to get a ‘bargain’ this year than last. However, as always, it depends on what’s happening in your local area: what’s for sale and how many people are looking.

To get a good picture of the market around you, speak to your local Your Move branch, our experts can help, whether you’re buying, selling or letting.

Are rents still rising?

Demand is continuing to outstrip supply in most areas, and rents are still being pushed upwards.

The record high annual increases we’ve seen over recent years were unheard of before the Welsh, Scottish and English governments started to clamp down on landlords, and we’re now seeing the effects of a slowdown in Buy to Let investment.

Scotland +8.2% (despite introducing rent controls!)

England +8.6%

Wales +7.9%

Source: the ONS

Although this is a slightly lower growth rate than we’ve seen over the last few years, it’s still above the 4-5% predicted by the industry.

Can rents keep rising?

Rents tend to move in line with wage growth, which currently stands at 4.5%. With inflation back around its long-term average of 2%, that means many tenants have more money in their pocket and they’re able to spend it on rent.

So, for as long as this is the case, and rental stock remains below demand levels, rents can and will keep rising.

What does this mean for landlords?

Overall, the forecasters have been pretty accurate for this year. For the rest of 2024, it’s likely that prices will rise by a few percent or more, rents will continue to grow by 5% or more and transactions will reach around 1.1million.

If you’re new to the market or looking to expand your portfolio, it will be harder than it has been over the past 18 months to find a good property at below true market value. You’ll need to network more with agents locally and should expect it to take a bit longer to find a deal. But on the plus side, you should benefit from lower mortgage rates moving forward.

If you already own property, there are two bits of good news. Firstly, your property is likely to recover some if not all of the value it might lost last year and, secondly, rental income should continue to grow by more than inflation, boosting your profits.

If you want to know more about what’s happening in your local market or you’d like some help finding a new investment, you can find the details for your local branch here.

If you would like to book a free lettings consultation with one of our award-winning lettings experts, simply enter your details here.

The Your Move Content Marketing Team